What is your Retirement Age?

- The FIRE Adventurer

- May 9, 2022

- 4 min read

In todays instalment aims to show you three things:

1/ Current monthly budget

2/ Total retirement pot needed

3/ How to calculate how long it will take to get there

Current monthly budget

Firstly let's go through your budget. In order to know how much you need to retire on understanding your requirements is key. So if you don't already start a monthly budget. Track all the spending you do and allocate it into different sections or categories. There are hundreds of options out there for you to download and use, some for free and some you need to pay. Use the free ones to get an idea and pick the bits you liked and make it applicable to your personal circumstances.

Be honest with this, there is literally no point in lying as you're only cheating yourself. The longer you use a budget tracker the more accurate it will be for understanding how much you need to live on.

The other benefit of a budget is that it allows you to track which activities you are spending heavy on. Some of which you may be happy with some of it not so much. For me I am content spending money on holidays and sport, but less so on cars and house. I budget and set up my sinking funds for all of these categories, and knowing if I am overspending allows me to cut back somewhere else if I need to or roll it over to the next month if I am able.

Once you have this running for a number of months it will give you an idea of your average monthly spend, which you can then use to calculate your annual spending.

Total retirement pot needed

A simple equation here to work out your retirement pot:

Retirement Pot = 25 x Annual Expenses

Use your figure from part one and multiply it by 25. For me it's 25 x £52,684 = £1,317,100

This is absolutely bloody terrifying.

So I have two options here - spend less or earn more. More on that in a future post!

We now know how much we need.

Bear in mind the figure about is with paying a mortgage, if I take that away I would need £1,044,650. Which is a lot nicer. I wouldn't class myself FI until my mortgage is paid off, so perhaps the second number is a little more accurate.

How to calculate how long it will take to get there

There is one final calculation we need to make which can be a little time consuming.

Calculate your current net worth. I did a recent series on my Instagram page and part of this series was showing people how to calculate their net worth.

Assets minus Liabilities = Net Worth

Assets as Robert Kiyosaki describes is any income generating so puts money in your pocket, and a liability takes money out of your pocket. In this example your own home you live in is not an asset. It will not generate any income if you live in it, even when you don't pay a mortgage.

To get an accurate net worth dig around for your pension statements, any loan or debt repayment statements your have. Everything. Be honest - brutally honest. This is a line in the sand moment.

Once you have your net worth we will find a gap from this to where we need to be of your retirement pot calculation in step 2.

Save this link:

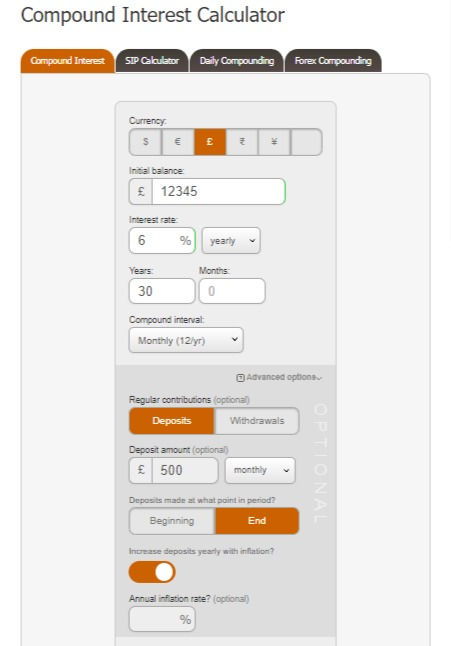

Use this to figure out how much you would need to contribute for a period of time to hit your number.

You can input your initial net worth, your expected (or hopeful investment return), monthly contributions and then review the year in which you would hit the number from step 2.

You are then given a table which you can then review to see how long it would take you to hit your marker. The table below is for the data I put in above. You can see from the balance on the right hand side within 20 years I would not have the £1million pot I need to retire.

However, things to note is that this table doesn't include my work-based pension. The contributions to this is separate to the £500 I would be investing outside of this.

Changing this to £1000 to include this increases my pot at 20 years from £271k to £502k. Still a way off from I need but a little closer. The year in which I hit £1million is actually 29 years. Which would be 'normal'-ish retirement age but I want to retire early. There is also a lot of presumptions here that for the next 29 years I will be able to contribute £500, and always within employment that has a good pension.

So hopefully following these steps you will see the raw honest numbers that are needed for you to retire with the lifestyle you wish. Sometimes it's humbling, other times frightening, but either way it's clear. Maths doesn't lie.

What are others opinions or experiences from doing this?

Any changes you would advise from what I set out?

In future blogs we are going to look at how we can bring this date closer.

Comments