Your Money or your Life Book Review

Thought provoking questions and exercises to revaluate your life choices

This book is recommended by many in the FIRE community and is very popular over in the States. A fair few podcasts I'd listened to, inlcuding Mad Fientist and Grant Sabatier mentioned it, along with the blog of Mr Money Moustache.

I'd delayed reading any more finance books and was holding off on this one until I hit a bit of a slump in motivation. I was quite content with my strategy the past 12-18 months but I knew eventually I would need some inspiration. I decided long ago that when that time came I would read this book as I believed it would align to my values that there is more to life than money, that you should chase 'Dreams not Dollars', and boy did it not disappoint.

This is the second version of the book with the originally being released in 1992 and Vicki Robin co-authored this with her friend Joe Dominguez. The most current release from 2008 has been updated with more relevant strategies for the modern investing world, along with real life examples from people who have benefited from the practices Vicki mentions.

This book is a classic for a reason and some of the points raised lead to some great reflection.

Overview:

The structure of the book splits the lessons across 9 steps. Vicki takes you from a complete novice and unpicks elements of your life, work and beliefs to help you improve your financial position.

The 9 steps in Your Money or Your Life are:

-

Make peace with your past

-

Calculate your real hourly wage

-

Track your expenses, then convert into hours

-

Ask yourself three questions

-

Chart your money

-

Spend less

-

Redefine work.

-

Find your crossover point.

-

Invest

Vicky uses real life examples on how the point she is trying to express relates to ever day people, and perhaps how making some of these changes could improve you life.

Initial Impressions:

For me step 2 was a real watershed moment. Looking at my real hourly wage was an eye opener on actually how little it was, and how much I am spending to work. Worryingly for others, I don't spend a huge amount on my work and it was still a shock, so it would be insane for other people. Linking this new metric into charting money and budgeting offered a whole new insight into how I spend my salary.

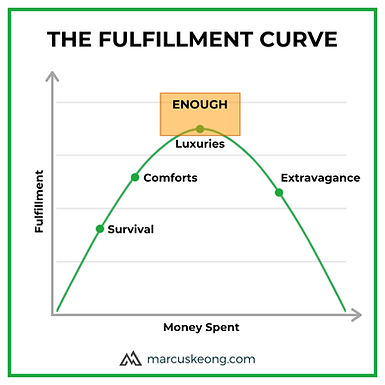

Some of the graphics used as well help explain the point clearly and if you are a visual learner then these will really ht home. This image below is explaining that eventually we have enough money, and that any more over this amount doesn't add any value. So by defining what life we need, and understanding what we get value from, can help us focus when we have 'enough', and not always think that more is better.

Things I loved:

1/ The logical steps of the chapters, which are the steps you need to follow, can take you from complete novice to fully independent of your finances.

2/ The practical exercises at the end of each step for you to do so you can apply the lessons hopefully learned. Learning my real hourly rate was shocking. It made me rethink my spending habits, along with the amount of effort I was putting in at work given the return in salary.

3/ The chapter about redefining work again prompted a lot of questions and self reflection. This book is all about rethinking the norm and questioning whether there is a better way of doing things.

Who is this book for?

I purposely left this book for a decent chunk of time, about 1 year, since I read a strategic financial book. I did this as I was happy with my motivation and plan, and held off on this until I found myself in a slump. Even with a decent background on financial knowledge I still found this really helpful. There is definitely a huge bias on the psychology of money and the habits you have, and only a small amount of text dedicated to the actual strategy on what to do.

I think this is a really important part of improving your finances which when you start off you aren't too interested in, but after a short period of investing you realise is crucial.

So whether you are a complete novice in the world of finance or investing, or a seasoned veteran needing to improve your relationship with money and the WHY you are on your journey, this book will help you on your way.

Conclusion:

A book that is unique to the normal finance book, where your beliefs and relationship with money are questioned, along with your life choices about your job. Some practical exercises to figure out where you stand and some great examples to help apply the lessons of the chapter.

Head over to Amazon UK for the latest offers and to purchase this book.

As an Amazon Associate I earn from qualifying purchases